Auto Loan Calculator

Calculate payments over the life of your Loan

Home Blog Privacy Terms About Contact

Calculate payments over the life of your Loan

Home Blog Privacy Terms About ContactPublished on October 13, 2025

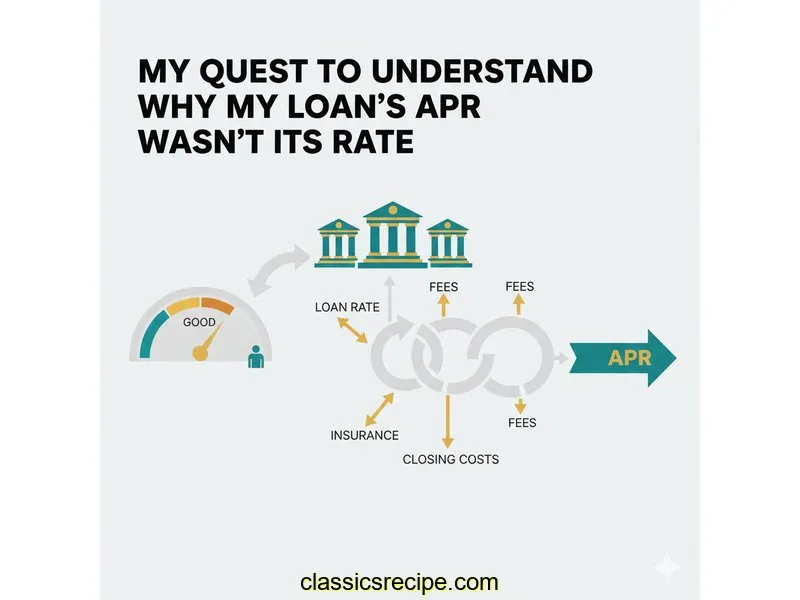

My journey into the world of personal finance calculations started with a single piece of paper. It was a sample loan offer I was looking at, purely for educational purposes, and two numbers were staring back at me, side-by-side: an interest rate of 6.7% and an APR of 7.42%. My first thought was that it had to be a typo. How could there be two different percentages for the same loan? Weren't they the same thing?

This simple question kicked off a weekend-long dive into online loan calculators. My goal wasn't to make a financial decision, but to solve a mathematical puzzle that was genuinely bugging me. I wanted to understand the "why" behind the numbers. If I put the loan amount, the term, and the interest rate into a calculator, shouldn't it all just work out perfectly? What was this mysterious APR, and why was it higher?

I started plugging numbers into a basic online loan calculator. I entered a principal amount of $13,850, a term of 60 months, and an interest rate of 6.7%. The calculator dutifully spat out a monthly payment. But this number didn't seem to align with the total cost implied by the higher APR. I felt like I was missing a key ingredient in the recipe, and the final dish just wasn't coming out right. This is my story of figuring out that missing ingredient. It’s about understanding how calculations work, not financial advice.

This whole experience was driven by sheer curiosity. I needed to know how two seemingly similar percentages could tell two slightly different stories about the cost of borrowing. It was a puzzle I was determined to solve, one calculation at a time.

Armed with my newfound curiosity, I dove headfirst into the online calculators. My mission was simple: make the numbers on my screen match the numbers on the sample document. I pulled up a standard loan calculator and carefully entered the data: a loan amount of $13,850, an interest rate of 6.7%, and a loan term of 60 months. The result was a monthly payment of $273.06.

This seemed straightforward enough. But then I looked at the APR of 7.42%. I knew intuitively that a higher percentage should mean a higher cost, but I couldn't figure out how to bridge the gap between 6.7% and 7.42%. I tried entering 7.42% as the interest rate instead. The calculator then showed a higher monthly payment, around $278. This was also wrong. Neither calculation was giving me the full picture, and the frustration began to set in.

My initial mistake was thinking the APR was just another name for the interest rate, maybe with some weird rounding. I kept looking at the main calculator fields: "Loan Amount," "Interest Rate," and "Term." What else was there? I spent an hour trying different combinations, wondering if I was doing the math wrong in my head or if the calculators themselves were flawed. Was there a hidden setting I was missing?

The real confusion came when I noticed a line in the fine print on the sample document: a "$250 origination fee." I had completely ignored it. In my mind, a fee was a separate, one-time charge. I assumed you'd just pay it upfront, and it had nothing to do with the ongoing interest calculations. I couldn’t understand how a flat $250 fee could transform a 6.7% rate into a 7.42% rate. This was the moment I realized I wasn't just using the calculator wrong; I was fundamentally misunderstanding one of the core concepts of loan math.

The breakthrough came, as it often does, from a tiny info icon next to an input field. I had found a more advanced loan calculator, and next to the "APR" field, there was a small question mark. I clicked it. The pop-up text said something that changed my entire understanding: "The Annual Percentage Rate (APR) is the cost you pay each year to borrow money, including fees, expressed as a percentage."

Including fees.

That was it. That was the missing ingredient. The APR wasn't just the interest rate; it was a more comprehensive measure of cost that bundled the interest rate and the loan's fees into a single number. The $250 origination fee wasn't a separate entity—it was mathematically woven into the fabric of the loan's cost, and that was reflected in the higher APR. This concept was a true "aha" moment for me.

My first step was internalizing that APR stands for Annual Percentage Rate. The keyword for me became "annual." It's a standardized way to show the full cost of a loan over one year. The interest rate only tells part of the story—the cost of borrowing the principal. The APR tells the whole story by including origination fees, closing costs, or other charges associated with the loan.

The next concept I had to grasp was how a flat fee could become a percentage. The math is complex, but the idea is simple. The lender calculates the monthly payments based on the full loan amount ($13,850) and the interest rate (6.7%). However, because you only received $13,600 in cash (after the fee was taken), you're paying interest on money you never got to use. The APR formula accounts for this, spreading the cost of that $250 fee over the 60 months of the loan, which results in a higher effective percentage rate.

Once I understood the concept, I knew what to look for. I started searching for "APR calculators" instead of just "loan calculators." These tools were designed for this exact purpose. They had the standard fields, but they also had an extra box labeled "Fees." When I entered $13,850 as the loan amount, 6.7% as the rate, 60 months as the term, and $250 in the fees box, the calculator returned an APR of 7.42%. It finally matched. The puzzle was solved, and I felt an incredible sense of accomplishment.

To confirm my new knowledge, I decided to test it with a completely different scenario. I imagined a loan of $18,200 for 72 months at a 7.1% interest rate, but this one had a $300 fee. Using my newfound skills and an APR calculator, I input all these variables. The calculator showed an estimated APR of 7.69%. I could now confidently see how the rate, term, and fees all worked together to create the final APR. I wasn't just guessing anymore; I understood the relationship between the numbers.

This deep dive was incredibly revealing. It took me from a state of confusion to a place of genuine understanding about how loan costs are actually calculated. It wasn't about making a financial choice, but about gaining literacy in the language of finance. Here are the biggest lessons I learned about the calculations themselves:

Think of it like this: the interest rate is used to calculate the amount of interest you'll pay on your loan's principal balance. The APR calculation starts with the interest rate but then incorporates the cost of any fees (like origination fees) by spreading them across the loan's term. This makes the APR a more complete measure of a loan's total cost.

Lenders are required by law (the Truth in Lending Act) to disclose the APR so that consumers can make fair comparisons. They show the interest rate because it's the number used to calculate your actual payment's interest portion, while the APR is the standardized measure of the total cost of credit.

While the underlying formula is very complex, the easiest and most reliable way is to use an online APR calculator. You'll need four key pieces of information: the total loan amount, the interest rate, the loan term (in months), and the total dollar amount of all fees. The calculator will run the complex formula for you and provide an accurate APR estimate.

Not necessarily. If a loan has no origination fees, closing costs, or other finance charges, its APR and interest rate will be the same. The APR only becomes higher when there are additional costs beyond the interest itself that need to be factored into the overall calculation.

My biggest takeaway from this entire process was the power of understanding what goes into a calculation. For hours, I was stuck because I was missing one variable: the fees. Once I learned that the APR calculation was specifically designed to include those fees, everything clicked into place. The numbers on the page were no longer a mystery; they were telling a logical story that I could finally read.

This journey wasn't about finding the "best" loan or making a financial move. It was about empowering myself with knowledge. Learning how to use the right tools—like a proper APR calculator—and understanding what each field meant gave me a new level of confidence. I'd encourage anyone who feels intimidated by financial numbers to simply get curious. Start with one question, just like I did, and follow it until you find the answer. The feeling of finally understanding the math behind the curtain is incredibly rewarding.

This article is about understanding calculations and using tools. For financial decisions, always consult a qualified financial professional.

Disclaimer: This article documents my personal journey learning about loan calculations and how to use financial calculators. This is educational content about understanding math and using tools—not financial advice. Actual loan terms, rates, and costs vary based on individual circumstances, creditworthiness, and lender policies. Calculator results are estimates for educational purposes. Always verify calculations with your lender and consult a qualified financial advisor before making any financial decisions.

About the Author: Written by Alex, someone who spent considerable time learning to understand personal finance calculations and use online financial tools effectively. I'm not a financial advisor, accountant, or loan officer—just someone passionate about financial literacy and helping others understand how the math works. This content is for educational purposes only.